📌 Small business capital strategies are more critical than ever in 2025. With markets shifting fast, access to flexible funding is no longer a luxury—it’s a necessity. Whether you’re scaling, stabilizing, or seizing a new opportunity, having the right funding approach gives your business the edge.

In this guide, we’ll break down the smartest ways to fund your business this year. We’ll cover traditional and non-traditional options, highlight trends, and show you how to access capital quickly without drowning in paperwork.

🔍 Why 2025 Is a Pivotal Year for Small Business Funding

We’re in a time of rapid transformation. Interest rates, inflation, AI disruption, and digital commerce are rewriting the playbook. Cash flow gaps, hiring needs, inventory demands—these don’t wait. That’s why small business owners need capital strategies that are:

- Fast to access

- Flexible in repayment

- Scalable with business growth

- Low on friction (less paperwork, fewer delays)

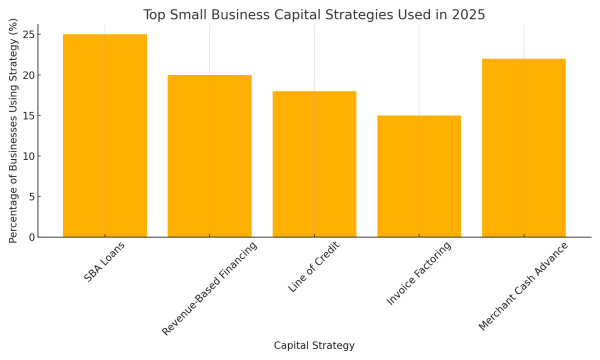

📈 Top Small Business Capital Strategies for 2025

Here’s a breakdown of the most popular options businesses are using to stay agile and competitive:

1. 🏦 SBA Loans (25%)

Still a strong option for businesses with time to wait and great credit. The downside? Long application cycles and strict criteria. Not ideal if you need funding now.

Best For: Long-term investments, equipment purchases, expansion.

2. 💸 Revenue-Based Financing (20%)

This is 2025’s rising star. Instead of fixed monthly payments, you repay based on a percentage of your revenue. It scales with your cash flow—if you make less, you pay less.

Best For: Seasonal businesses, eCommerce, fast-growth startups.

3. 🔄 Line of Credit (18%)

Like a credit card, but for business needs. You draw only what you need, pay interest on what you use, and refill the balance as you repay.

Pros:

- Flexible usage

- Great for recurring needs

Cons:

- Requires good credit

- Often slow approval

4. 🧾 Invoice Factoring (15%)

Turn your unpaid invoices into instant cash. Great for B2B businesses who can’t afford to wait 30-90 days for clients to pay.

Key Benefit: Fast liquidity based on work already done.

5. 💳 Merchant Cash Advance (22%)

You get a lump sum upfront, then repay it with a % of daily card sales. Perfect for retail, restaurants, and service-based businesses.

🔥 Tip: MCAs can fund within 24-48 hours. That’s speed you can’t get from banks.

📊 Pros & Cons: Quick Comparison Table

| Strategy | Speed | Flexibility | Best For | Caution |

|---|---|---|---|---|

| SBA Loans | Slow 🐢 | Low | Stable growth | Paperwork overload |

| Revenue-Based Financing | Fast ⚡ | High | Online/Seasonal businesses | Slightly higher costs |

| Line of Credit | Medium ⏳ | Medium | Recurring expenses | Credit score dependent |

| Invoice Factoring | Fast ⚡ | Medium | B2B with unpaid invoices | Relies on customer payments |

| Merchant Cash Advance | Very Fast 🚀 | High | Retail/service-based | Higher fees if unmanaged |

🧠 Choosing the Right Capital Strategy

Here’s how to know what works for you:

✅ Need fast access to cash? → Go with Revenue-Based Financing or MCA

✅ Waiting on invoices? → Use Factoring

✅ Need a credit line for flexibility? → Apply for a Line of Credit

✅ Stable business with time to wait? → Consider SBA Loans

📊 Capital Strategy Trends to Watch in 2025

- Embedded finance is making funding seamless—platforms like Fundo let you apply directly from your dashboard.

- AI-powered underwriting means faster decisions and more personalized terms.

- Cash flow-based lending is replacing credit-score-only models.

- Alternative lenders are outpacing banks for speed, service, and simplicity.

⚡ Get Funded Fast With Fundo

If you need funding that matches your pace, Fundo is your partner. We offer:

💼 Simple applications

💰 Fast approvals

🔁 Flexible repayments

🙌 Support from real people, not bots

Don’t wait while banks stall. Get the capital you need to take your business to the next level—on your terms.

👉 Ready to move fast? Apply now with Fundo and get funded today.

📊 The Rise (and Fall) of Small Business Capital Strategies: 2021–2025 Trends

Understanding how capital strategies have evolved over the past five years helps us predict where funding is headed next. Here’s a look at how small businesses shifted their funding preferences from 2021 through 2025.

🚀 Trends in Usage Over Time

Key Takeaways:

-

SBA Loans have declined in popularity, largely due to the slow and paper-heavy process.

-

Revenue-Based Financing surged thanks to its flexibility and alignment with cash flow.

-

Lines of Credit are seeing a slow taper, especially with interest rate volatility.

-

Invoice Factoring has dipped slightly as digital payments reduce invoice lag.

-

Merchant Cash Advances remain stable, showing that speed and ease still matter to business owners.

🧮 Capital Strategy Selector: Which One Fits Your Business? (Quiz-Style Format)

Let’s simplify your decision. Choose the answers that match your situation:

🏁 1. What is your top priority?

-

✅ Speed — I need cash now ➡️ MCA / Revenue-Based Financing

-

✅ Low cost — I can wait for better terms ➡️ SBA Loan

-

✅ Flexibility — I need to draw and repay on demand ➡️ Line of Credit

📊 2. How steady is your cash flow?

-

✅ Consistent monthly revenue ➡️ SBA / Line of Credit

-

✅ Fluctuates a lot ➡️ Revenue-Based / MCA

-

✅ Backed by unpaid invoices ➡️ Invoice Factoring

⏳ 3. How fast do you need funds?

| Need Speed | Strategy |

|---|---|

| 🚨 Within 1–2 days | MCA, Revenue-Based Financing |

| 📆 Within 1 week | Invoice Factoring, Line of Credit |

| 🕰️ 2–4 weeks | SBA Loans |

💡 Expert Tips for Securing Capital in 2025

Even the best strategy fails if your application isn’t airtight. Here’s how to boost your chances of approval—fast:

📁 1. Prepare Clean, Recent Financials

Whether it’s your bank statements, tax returns, or revenue dashboards—accuracy matters. Lenders now use data-driven underwriting powered by AI, so even small inconsistencies can slow you down.

🧾 2. Show Stable (or Growing) Revenue

Even if you’re a startup, showing consistent growth or a clear revenue trend line helps justify your funding request. Bonus points if you use real-time dashboards like QuickBooks, Shopify, or Square to back it up.

💬 3. Keep Business & Personal Finances Separate

Mingling the two is a red flag. Separate accounts = more credibility = faster decisions.

📈 4. Use Capital Strategically, Not Just Urgently

Capitalize on opportunities, not just emergencies. Want to buy inventory at a 40% discount? That’s smart. Need cash to plug a surprise tax bill? That’s reactive.

🤖 How AI Is Changing Small Business Lending in 2025

Tech is transforming finance—and small business capital strategies are right in the crosshairs. Here’s what’s hot:

✅ Real-Time Risk Assessment

Gone are the days of waiting weeks for underwriting. AI models now scan your revenue, expenses, industry, and even website traffic to deliver a funding decision in minutes.

🧠 Personalized Repayment Models

Forget “one-size-fits-all.” New lenders (like Fundo 👋) tailor repayments based on your sales cycle—daily, weekly, or monthly.

🕵️♂️ Fraud Prevention via Behavioral Data

Machine learning flags inconsistencies (e.g., location mismatches, irregular transaction spikes) to reduce fraud—and protect legit business owners.

🧩 Combining Capital Strategies (The Hybrid Method)

Why choose just one?

More and more businesses are blending funding types to stay nimble and fully capitalized. Here’s how:

💳 Example Hybrid Approach:

| Need | Strategy | Why |

|---|---|---|

| Working Capital | Line of Credit | Draw as needed |

| Inventory | MCA | Quick access, repay via daily sales |

| Expansion | SBA Loan | Long-term fixed rates |

🎯 When to Combine:

-

You have seasonal spikes and need both quick cash and long-term investment.

-

You want to protect your cash flow by spreading repayments across different streams.

-

You qualify for multiple products and want to stack responsibly.

🌍 Industry-Specific Capital Insights

Different industries lean toward different capital strategies. Here’s a breakdown:

🛍️ Retail & eCommerce

-

Top Strategy: Merchant Cash Advance

-

Why: Easy to link repayment to daily credit card sales

🏗️ Construction & Contractors

-

Top Strategy: Invoice Factoring

-

Why: They often wait 30–90 days for payment

🧑🍳 Restaurants & Cafes

-

Top Strategy: Line of Credit + MCA

-

Why: Covers daily operations and emergency repairs

📦 B2B Services

-

Top Strategy: Revenue-Based Financing

-

Why: Their cash flow rises and falls with contracts

🧰 Tools to Track & Manage Business Funding in 2025

Use tech to keep your capital strategy smart and stress-free:

| Tool | Function | Bonus |

|---|---|---|

| QuickBooks | Expense tracking | Syncs with lenders |

| Shopify Capital | In-platform funding | Great for eComm |

| Brex / Ramp | Smart business cards | Budget control |

| Fundo 📈 | Fast capital with flexible terms | Apply directly from your dashboard! |

🧭 Future Outlook: What’s Next for Capital in 2026?

Looking ahead:

-

AI loan matchmaking will become standard—matching you to offers in real-time.

-

Crypto-backed loans may rise, especially for online businesses.

-

Integrated lending inside payroll, accounting, and POS tools will remove friction entirely.

In short: Speed, simplicity, and personalization will define the next era of business capital.

📣 Final Word: Get Funded with Fundo Today 💰

You’ve seen the strategies. You’ve seen the data. Now it’s your move.

At Fundo, we make it simple:

✅ No paperwork chaos

✅ No long waits

✅ Just fast, flexible capital designed for your real-world business needs

Ready to take control of your cash flow?

👉 Apply now with Fundo and get funded today.

Disclaimer:

Fundo offers Revenue Based Financing programs exclusively for business use. Any references to loan products, consumer products, or other financing forms are solely for marketing and educational purposes, aiming to differentiate Fundo's product from other similar financing options in the market.